The Outlook For H2 2025

Market forecasts and trade body predictions suggest a continued and potentially evolving trend in the UK home renovation market. Firstly, energy...

Read Full Article

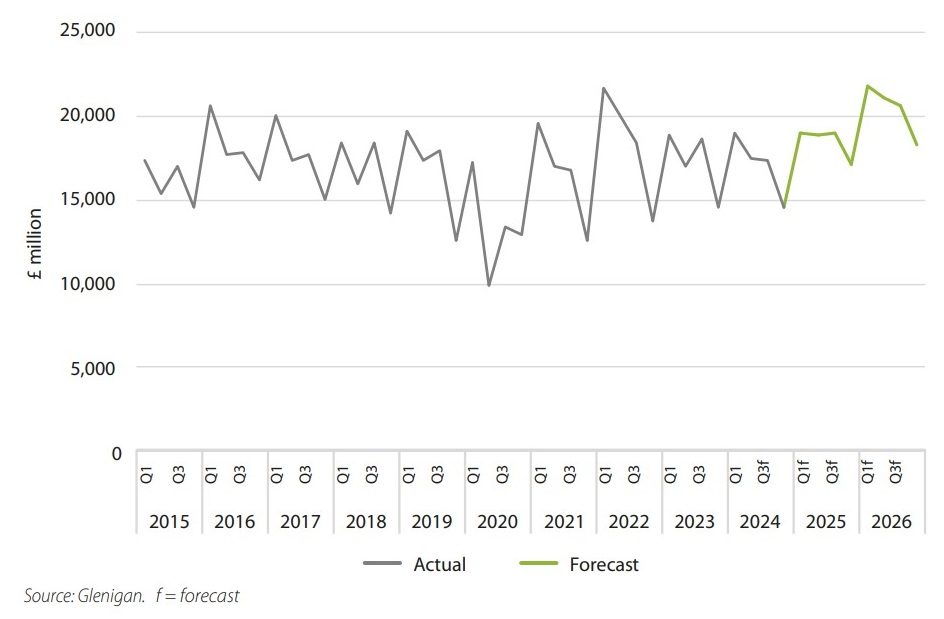

Glenigan has released its widely anticipated UK Construction Industry Forecast 2025-2026 – which says project-starts will continue to strengthen as the UK economic growth gathers momentum.

Renewed construction growth is forecast for 2025 (+8%) and 2026 (+10%) as the prospect of a recovering market lifts consumer and business confidence, boosting the industry.

Glenigan’s economic director Allan Wilen says: “The construction sector is on track for growth from 2025, fuelled by a combination of improved consumer confidence, increased household spending and strategic fiscal changes announced in the recent budget. These factors are set to drive activity in consumer-related verticals such as private housing, retail and hotel & leisure.

“The budget's adjustments to fiscal rules, allowing for higher levels of capital investment, will also unlock significant public sector and infrastructure projects, providing a much-needed boost to government-funded initiatives over the next two years."

Housing starts on the up (2025 +13% , 2026 +15%)

Private housing market activity has stabilised during the second half of 2024 thanks to a brighter economic outlook and improvement in household incomes.

This may prompt buyers to take advantage of reasonable house prices, helping to support further recovery during 2025 (+13%) and 2026 (+15%) as housebuilders respond to improved consumer confidence and strengthening property transactions.

While housing approvals have been on a downward trend for most of 2024, government planning reforms are anticipated to reverse this trend, paving the way for an uptick in new approvals and housing developments over the forecast period.

Additionally, the budget’s £3 billion support package for SMEs and the build-to-rent sector should provide a boost to new and smaller developers, further lifting the overall housing supply.

Help for social housing (2025 +11% , 2026 +11%)

Greater cost stability and increased government funding have helped housing associations increase their development activity.

However, a drop in student accommodation projects has dampened overall sector starts this year, causing an estimated fallback in project-starts of 15%.

This is likely a short-term setback and new government policies are anticipated to increase development activity over the next two years, including an extra £500 million funding for the Affordable Homes Programme. The government is also reducing the discounts on right-to-buy sales, with local authorities able to retain full earnings from council house sales to fund new social housing.

In a reversal of fortunes, student accommodation is forecast to expand, driven by easing interest rates and rising demand for purpose-built developments as buy-to-let investors leave the market.

All this will help lift social housing starts, with 11% growth forecast for 2025, and 11% for 2026.

Consumer spending to lift industrial starts (2025 +5%, 2026 +8%)

Industrial starts are forecast to return to growth over the next two years. A stronger economic outlook is expected to drive online retail, encouraging a demand revival for premises next year with a 5% predicted growth in 2025, and 8% in 2026.Although planning approvals fell back this year, there is a strong pool of previously approved projects that developers and investors can take forward over the next two years, in response to the resurging demand for industrial floorspace.

Shops and supermarkets to spark retail revival (2025 +1%, 2026 +9%)

A revival in consumer spending is anticipated to support a gradual recovery in the sector. Project-starts are expected to see steady growth, with Glenigan forecasting a 14% increase in the near term, followed by a 1% rise in 2025 and 9% in 2026.

Full recovery for hospitality (2025 +6% , 2026 +9%)

Rising household incomes is expected to boost discretionary spending on hospitality and leisure, attracting investors and driving project-starts. As such, Glenigan forecasts growth of 19% in 2024, 6% in 2025 and 9% in 2026.

Opportunities for offices (2025 +18% , 2026 +4%)

The sector, which includes data centres, has been affected by high interest rates and reduced demand for office spaces. However, it is expected to benefit over the forecast period from a rise in refurbishment and extension projects, as hybrid working remains an important driver for landlords and occupiers to accommodate changing working patterns.

NHS funding to fuel growth in healthcare projects

While the NHS remains a high priority for the government, a 17% decline in detailed planning approvals during the first nine months of 2024 may limit new projects in the near term. However, increased funding should boost healthcare projects over the forecast period resulting in growth in 2025 +1% and 2026 +10%.

Surge in school works (2025 +3%, 2026 0%)

The education sector is forecast to grow by 5% next year, then stabilise in 2026. School building projects will likely remain the sector’s main driver, supported by a 22% capital budget increase in 2025/26, including an additional £500 million for the School Rebuilding Programme.

Picture: Graph Showing Value of Underlying (under £100 million) Project-Starts

Article written by Brian Shillibeer

29th November 2024