Programme Launches To Prevent Employee Addiction Crisis

The UK’s leading addiction treatment specialist, UKAT, has launched a new programme aimed at helping those working in the Building & Construction...

Read Full Article

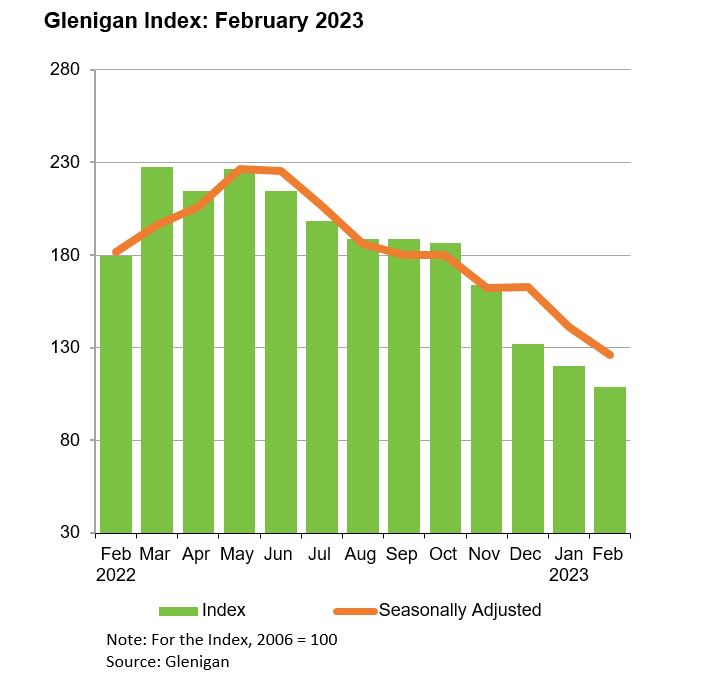

Glenigan has released the March 2023 edition of its Construction Index focussing on the three months to the end of February 2023. Residential construction starts slipped back 27% on the preceding three months and 43% against the previous year.

Similar to the January and February Indexes, the March edition paints a grim picture of a sector-wide decline. Performance continues to falter in Q.1 2023 amid price inflation, economic uncertainty, and lukewarm investor appetite. This is evidenced by a whopping 40% drop in starts compared to 2022 figures and a 22% decline against the preceding three months.

Commenting on the results, Glenigan’s Economic Director, Allan Willen, says: “Many will be disappointed to see performance levels continue to proceed on their downward trajectory, yet given the current economic malaise it’s hardly surprising. The year got off on a slow footing, with a further weakening in project starts during the three months to February reflecting the ongoing ripple effect of international conflict, weak economic policy, disrupted supply chains and rising costs.

“Consumers and investors are spending thriftily with many holding back until a degree of certainty returns to the economy. This is having a knock-on effect for the construction sector, prompting many contractors to follow suit and ride out the storm before committing shovel to soil.”

Residential

Residential construction experienced overall decline in the three months to February as starts fell 27% to stand 43% lower than a year ago.

Private housing performance was particularly weak, finishing 29% down against the preceding three months and 39% compared with the previous year. Social housing also dropped back, with work starting on site falling 22% against the previous three-month period and plummeting 57% on 2022 levels.

Industrial project-start performance was dismal, suffering a 41% fall. Offices followed a similar trend, with the value of underlying project starts falling back 23% against the preceding three months to stand 28% down on a year ago. Health project starts also slipped back, declining 34%; and education starts fell down a modest 1% against the preceding three months but remained 24% lower than 2022 levels.

Regional

Regional performance was poor, with most of the UK experiencing a weakening in project starts during the three months to February. However, the North-East remained a bright spot in the general gloom, with project starts performing relatively well compared to the rest of the UK, increasing 19% against the preceding three months. Despite this, starts failed to match 2022 levels, remaining 20% behind.

It was a similar story in the South East, with the value of project-starts increasing 5% against the preceding three months but remaining significantly down (-27%) on the previous year.

London and the South-West weakened against the preceding three months, falling back 18% and 15%, respectively. Both regions were down on the previous year, remaining 46% and 34% lower than a year ago.

Some areas of the UK fared even worse, including Scotland where the value of project-starts fell 31% against the preceding three months to stand 35% down on a year ago. This was also the case in the East Midlands, West Midlands, and the North-West which all crashed compared to the preceding three months and previous year.

Yorkshire & the Humber suffered the heaviest fall in project-starts, declining 53% against the previous three months to stand 61% down on a year ago.

Picture: Construction starts have flatlined.

www.glenigan.com

Article written by Cathryn Ellis

09th March 2023