Standing Tall – Gold For Unique

Unique Window Systems has successfully met the stringent criteria necessary to become a gold member of Constructionline. In order to achieve this...

Read Full Article

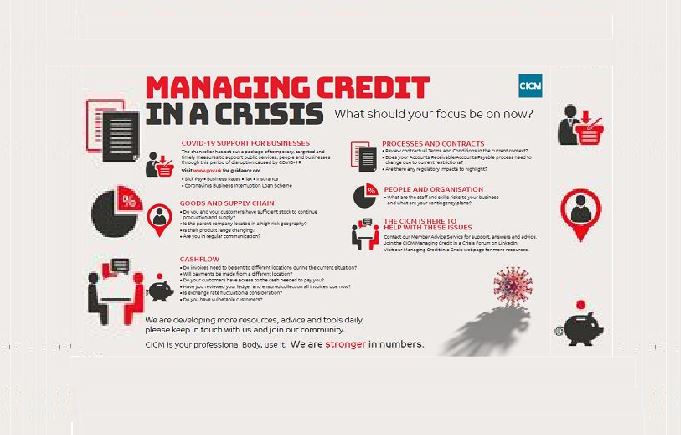

The Chartered Institute of Credit Management has launched A Managing Credit in a Crisis suite of tools and services for all credit professionals - with two of its services open to all for three months.

The two free services are the Chartered Institute of Credit Management (CICM) Member Advice Service and CICM Update.

The Managing Credit in a Crisis tools and advice does not contain much information as at March 29 - but the CICM charity will be adding information daily.

The organisation has invited anyone to pass this link on to as many colleagues as they wish.

The CICM's Prompt Payment Code moves to Small Business Commissioner’s office

On March 10, the Institute transferred the hosting and administration of the Prompt Payment Code (PPC) to the Small Business Commissioner’s office in line with the government’s stated ambition to bring all late payment initiatives under a single umbrella.

Since its launch in 2008, the Code has played an important part in promoting a culture of prompt payment, committing signatories to pay 95% of invoices within 60 days and work towards 30 days as normal practice.

In the last 12 months, businesses that have failed to honour those commitments have been removed and only re-instated when a suitable remedial plan has been approved by the PPC’s Compliance Board.

Sue Chapple, the CICM’s interim Chief Executive, says it makes perfect sense to streamline payment issues under the Commissioner’s remit: “Small businesses want a single body to whom they can turn for advice. By transferring responsibility for the Code to the Commissioner’s office, we can ensure the Code receives the investment and resources it needs to continue its success in transforming the payment landscape and promoting best practice.

“Signing up to the Code is voluntary, so we will be working with the Commissioner and trade bodies including the CICM to help increase the number of businesses on the Code, including targeting those we know are already meeting the standard through their PPR data.”

– Sue Chapple

Chartered Institute of Credit Management, Interim Chief Executive

Signatories to the Code

To date there are more than 2,500 signatories to the Code. In the last 12 months - and a change in policy to allow those who had failed to honour their Code commitments to be named publicly - 55 businesses have been suspended and 26 re-instated, the latter having demonstrated a substantial improvement in payment performance that warrants re-instatement.

“This is the Code working at its best,” Chapple continues. “Throwing people off is the easy part,. What encourages me and shows that the Code has real power, are the actions taken by half of all those suspended to have their businesses re-instated.

"That says to me that they want to be seen to be fair to their suppliers and they recognise the harm that can be done to their brands by failing to comply."

Credit Warning

February 12 saw eleven firms suspended from the Prompt Payment Code. They are:

Bottomline Technologies Limited, Shell U.K. Limited, BAE Systems (Military Air) Overseas Limited, BAE Systems (Operations) Limited, Cereform Limited, FM Conway Limited, Leonardo MW Limited, Macdonald Humfrey (Automation) Limited, Rhodar Limited, Sita Information Networking Computing UK Limited, Smiths Detection.

Re-installed - including Persimmon Homes

In addition to the 11 new businesses named and shamed, a further 14 businesses have been re-instated to the Code since the last announcement in November 2019. These are: British Sugar Plc, Ferrovial Agroman (UK) Limited, Fujitsu Services Limited and John Sisk & Son Limited, Persimmon Homes Limited, Smith & Nephew UK Limited, T.J. Smith & Nephew Limited, Vodafone Limited. Balfour Beatty Group Limited, Engie Services Limited, Kier Construction Limited, Kier Infrastructure and Overseas Limited, Galliford Try Plc, Laing O’Rourke

Picture: Managing Credit in a Crisis.

Article written by Cathryn Ellis

30th March 2020