Green Shoots Of Housing Recovery For 2024?

The construction sector rate of slump was the slowest since the current phase of decline began. While there was a good rise in repair, maintenance and...

Read Full Article

The pace of decline in the construction sector eased slightly in August. However, the Purchasing Managers’ Index remains below 50, highlighting a continued slowdown in activity and investment in the face of uncertainty and increased financial pressures.

This is the view of Joe Sullivan, a partner at MHA, the tax and business advisor as he reviewed last week’s (4 September) S&P Global report for UK construction which covers the backlook at everything from housebuilding to civils.

Sullivan said: “The ongoing rumours of a new Stamp Duty Land Tax and a 'mansion tax' are creating a significant drag on the property market. This policy uncertainty is already stalling investment across the UK.

“Further speculation over a national property tax, changes to Capital Gains Tax and Inheritance Tax and a potential new National Insurance charge on rental income are causing would-be investors to delay decisions and are already having an impact on transaction volumes.

“The Autumn Budget being delayed until 26 November is therefore unhelpful. There is also an indirect potential hit to construction volumes as potential changes to pension taxation could reduce investment in property funds.”

Drag on building

Sullivan added: “The current tax system, particularly Stamp Duty, is a structural drag on the market. It discourages both up-sizers and down-sizers, creating a lack of mobility that is bad for everyone. By disincentivising people from moving, it not only reduces transaction volumes but ultimately lowers overall tax receipts.”

What S&P Global said

UK construction activity fell for the eighth month in a row, albeit at slower pace than in July.

There are very obvious reductions in new work and employment optimism has dropped to its lowest since December 2022 – the same month when activity optimism was at its lowest ebb activity.

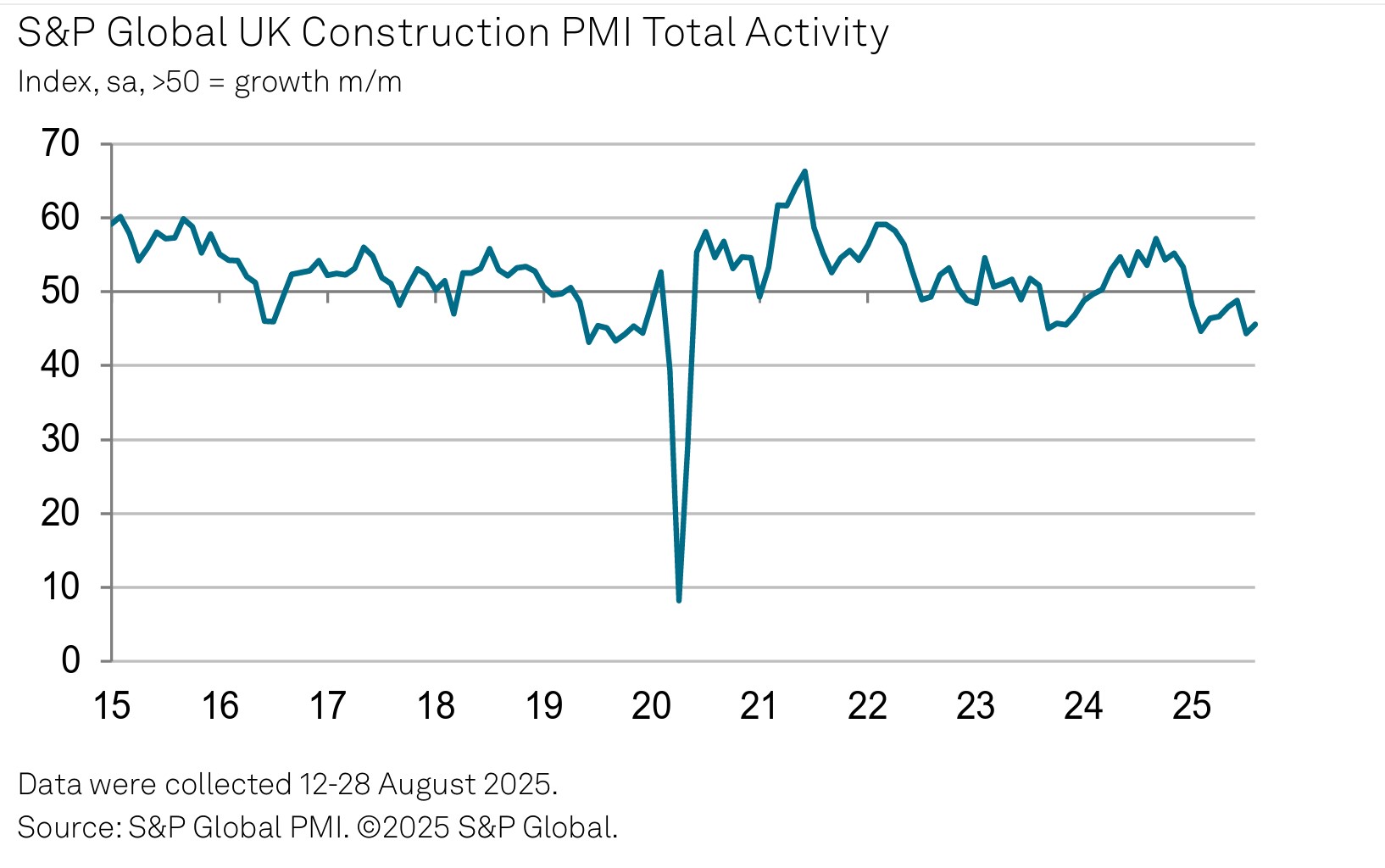

The S&P Global UK Construction Purchasing Managers’ Index is a seasonally adjusted index tracking changes in total industry activity. It uses a scoring system that registered 45.5 in August, up from 44.3 in July (which was the lowest reading for just over five years). Any score below 50.0 vindicates decline. Any score above,, indicates growth.

In August a slower reduction in commercial building (index at 47.8) helped to offset steeper declines in residential (44.2) and civil engineering activity (38.1).

The latest reduction in output across the house building category was the sharpest since February.

Why?

Construction companies widely commented on challenging market conditions, intense price competition and headwinds from sluggish UK economic activity.

Lower volumes of output and incoming new work led to hiring freezes and the non-replacement of departing staff in August.

Employment numbers have fallen throughout 2025 to date and the latest reduction was the fastest since May. A number of firms commented on efforts to mitigate rising payroll costs by cutting back on recruitment.

Subcontractor usage also decreased markedly in August and at one of the fastest rates seen over the past five years.

Construction products

A lack of forthcoming project starts led to a solid reduction in purchasing activity across the construction sector. The latest decline in input buying was the sharpest for three months.

Subdued demand for construction products and materials led to shorter wait times for supplier deliveries in August. Purchasing prices increased at the slowest pace since October 2024, despite ongoing reports of suppliers seeking to pass on higher wages and transportation costs.

Comment

Tim Moore, the economics director at S&P Global Market Intelligence, said: "Construction activity has decreased throughout the year to-date, which is the longest continuous downturn since early-2020. August data signalled only a partial easing in the speed of decline after output fell at the fastest pace for over five years in July.

"Sharply reduced levels of housing and civil engineering activity were again the main reasons for a weak overall construction sector performance.

“Commercial work showed some resilience in August, with the downturn the least marked for three months.

"There were some positive signals on the supply side as vendors' delivery times shortened, subcontractor availability improved and purchasing price inflation hit a ten-month low. However, easing supply conditions mostly reflected subdued demand and a lack of new projects.

"Elevated business uncertainty and worries about broader prospects for the UK economy meant that construction sector optimism weakened in August. The proportion of panel members expecting a rise in output over the year ahead was 34%, down from 37% in July and lower than at any time since December 2022."

Picture: The S&P Global UK Construction Purchasing Managers’ Index for August.

Article written by Cathryn Ellis

12th September 2025