When The Going Gets Tough Look For Positives

There is no doubt that 2023 is proving harder than 2022, with many in glass and glazing saying the market is around 15%-20% down on last year, yet there...

Read Full Article

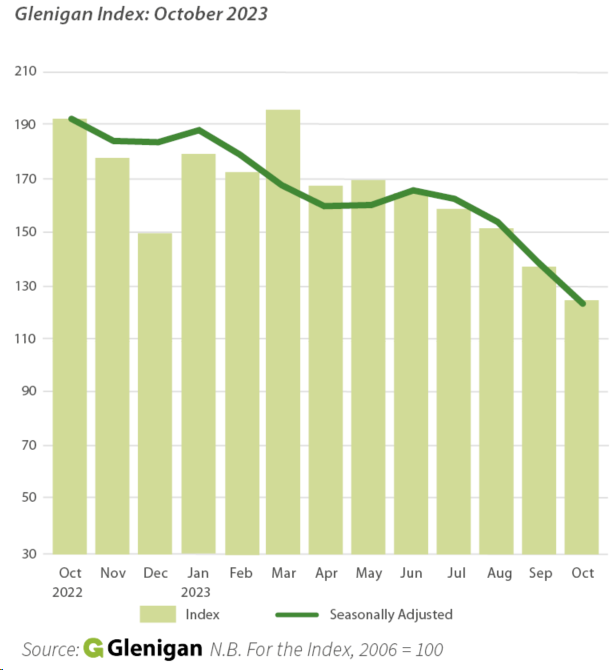

Glenigan, the construction insight expert, has released the November 2023 edition of its Construction Index focusing on the three months to the end of October 2023 – and it paints a dismal picture.

It shows the sector is continuing to spiral downwards, with the overall value of work commencing on site falling by a quarter compared to the previous three months, finishing 35% lower than 2022 levels.

In fact, performance in the November Index was so poor that not one vertical registered an uptick in activity, either against the preceding three months to October or last year’s figures, representing a universal decline.

No doubt the unusual blend of ongoing global economic pressures and persistent political uncertainty on the home front is continuing to dent investor and consumer confidence, stifling short-term recovery.

The recent policy U-turn on HS2 will have also been a contributing factor to a sudden dip in previously resurgent verticals, particularly civils and residential.

Waiting for stability

Commenting on the lacklustre results, Allan Wilen, Glenigan’s economic director, says, “The November Index will make for disappointing reading as previous editions hinted that green shoots of recovery were starting to poke through.

“Frustratingly, high interest rates and a weak economy continue to depress the market, reducing the appetite to commence projects until markets stabilise.

“Government departments are also struggling to prioritise capital projects, despite last year’s capital underspends being rolled forward to the current financial year. Many contractors and developers have been left high and dry by the recent decision to can HS2 Phase 2.”

Residential

Residential starts fell significantly during the Index period, with starts down 30% on 2022 levels, falling back 23% during the preceding three months.

Drilling deeper, private housing decreased by a fifth (-22%) against the preceding three months and weakened 25% compared with the previous year. Social housing fared even worse, with performance slashed almost in half (-46%) against 2022 figures, plummeting 30% on the previous three months.

Non-Residential

Performance in non-residential was dismal, painting a picture of widespread decline. Hotel and leisure suffered the sharpest fall, dropping 68% on last year and 57% against the previous three months. Health starts also experienced a poor period, cascading by 43% compared to the preceding three months, down 34% compared to 2022 levels. Similarly, industrial project starts were 57% lower than last year, falling 32% against the previous three months.

Others

Education and community & amenity project starts decreased 28% and 5%, respectively, against the three months to the end of October, standing 21% and 24% lower than the previous year, respectively.

Whilst retail only decreased 3% against the previous three months, it declined 36% against the previous year.

Civils finished 36% down on a year ago, with work starting on site falling back by almost a fifth (-18%) compared to the preceding three months. Infrastructure decreased 15% against the preceding three months and remained 38% down on 2022 levels. Utilities starts declined by 32% against 2022 levels and 22% on the previous three months.

Picture: Construction continues its decline with non-residential leading the way but with residential housebuilding not so far away.

Article written by Cathryn Ellis

14th November 2023